The 2008 Global Financial Crisis (GFC) is widely seen as the most severe economic downturn since the Great Depression. It reshaped financial markets, led to massive government interventions, and altered the trajectory of global economies. But what if the financial meltdown never happened? What if Lehman Brothers hadn’t collapsed, and the banking sector had held together?

While this scenario may seem like a financial “butterfly effect” moment, the reality is that the U.S. economy was already showing signs of deep trouble before the crisis hit. In fact, in the spring and summer of 2008, the U.S. was experiencing stagflationary conditions—a toxic mix of high inflation, weak growth, and rising unemployment. If the financial crisis hadn’t triggered a global collapse, the economy might have stumbled into a different kind of recession—one more reminiscent of the 1970s than 2008.

Let’s explore what could have happened in this alternative timeline.

1. Stagflation Deepens Instead of a Deflationary Crash

By mid-2008, the U.S. economy was already struggling under the weight of high inflation and slowing growth:

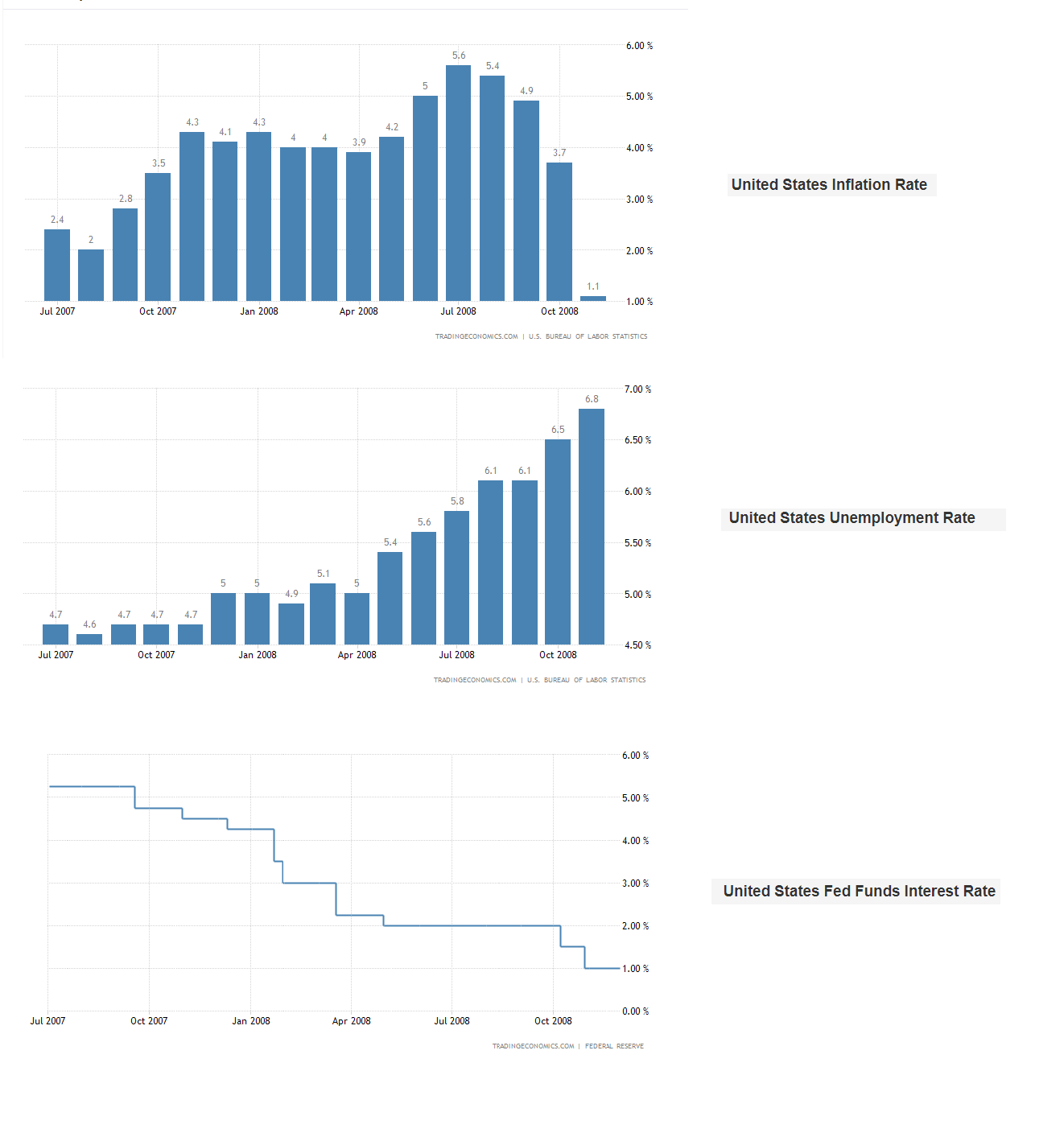

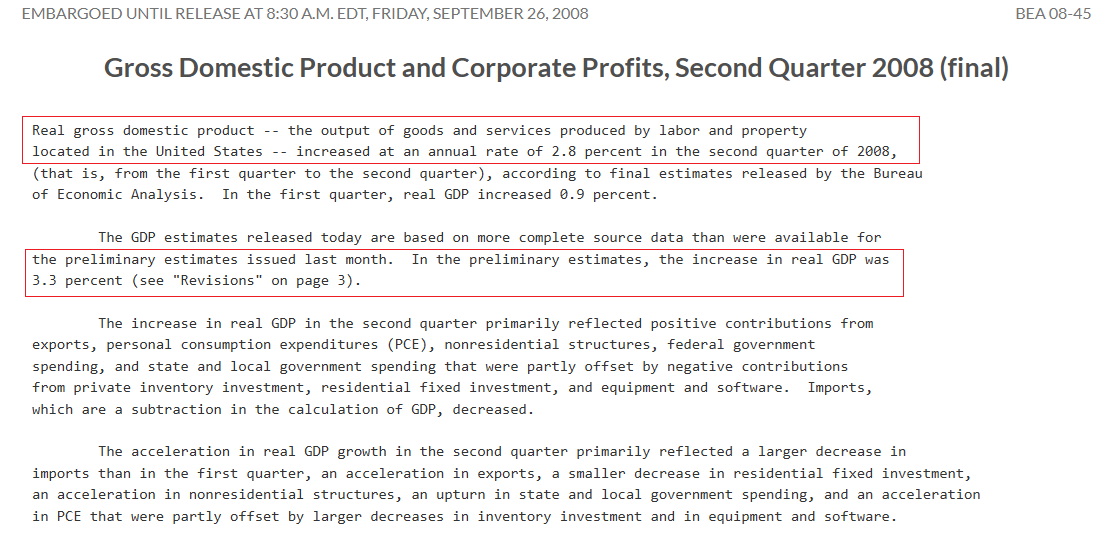

Inflation peaked at 5.6% in July 2008, the highest level in nearly two decades, fueled by skyrocketing oil prices, which hit $147 per barrel. Economic growth was sluggish—the economy expanded by just 1.0% in Q1 and 2.1% in Q2, boosted by government stimulus checks, but momentum was fading. Unemployment was rising, reaching 6.1% by September 2008—up from 4.8% earlier that year. In our alternate timeline—without a financial collapse—the economy would likely have continued down this stagflationary path.

High energy and food prices would have kept inflation stubbornly high, eating into consumers’ purchasing power. At the same time, businesses—facing rising costs and declining consumer demand—would have cut jobs, leading to a prolonged period of economic stagnation.

Instead of a sharp financial panic and credit freeze, the U.S. might have entered a slower, grinding inflation-driven recession.

Note “September 2008”, on the precipice of the GFC. Image: Federal Reserve

2. The Federal Reserve Faces an Impossible Choice

In reality, after the GFC, the Federal Reserve slashed interest rates to near zero and injected liquidity into the financial system through emergency programs. But what if the crisis hadn’t happened?

The Fed would have faced a painful dilemma:

If it cut rates further to support growth, inflation could have surged even higher, potentially spiraling out of control. If it raised rates to fight inflation, it could have triggered a recession by making borrowing more expensive for businesses and consumers. Given the Fed’s historical sensitivity to inflation, it’s likely that policymakers would have hesitated to cut rates too aggressively, meaning the economy might have slowed further without monetary relief.

The result? A longer, drawn-out economic slowdown, similar to the 1970s, when inflation and stagnation coexisted, forcing the Fed into a years-long struggle to stabilize the economy.

3. Oil Prices Stay High, Further Straining Households

One of the biggest consequences of the GFC was a sharp collapse in global demand, which caused oil prices to plummet from $147 per barrel in mid-2008 to just $30 by early 2009.

In our alternate reality, with no financial collapse, demand for oil likely would have remained strong for longer, keeping prices above $100 per barrel for an extended period.

Gasoline, heating, and transportation costs would have remained high, squeezing middle-class households. Businesses facing higher input costs might have raised prices, fueling further inflation. Emerging markets like China and India—which were still growing at a rapid pace in 2008—would have sustained demand for raw materials, keeping commodity prices elevated. In short, consumers and businesses alike would have faced a prolonged period of expensive living costs without an obvious economic recovery in sight.

4. A Slower, More Gradual Recession Instead of a Collapse

Would the U.S. have entered a recession anyway? Most likely, yes.

But instead of the rapid collapse of late 2008 and early 2009, it might have been a slower, more gradual economic downturn, driven by high inflation and weak demand.

The housing market was already in decline. While the banking crisis accelerated the housing crash, home prices had already peaked in 2006 and were falling steadily. Job losses would have continued, though perhaps at a less extreme pace than in 2008-2009. Corporate bankruptcies would have risen, particularly in industries heavily dependent on credit, but without a full-blown banking collapse. By 2009 or 2010, the economy might have faced a scenario more like the recessions of the 1970s and early 1980s, rather than the deep, deflationary crisis we actually experienced.

5. Would the Financial Bubble Have Grown Bigger?

Perhaps the most intriguing question is whether avoiding the GFC in 2008 would have simply delayed an even bigger crisis later on.

Before 2008, financial institutions were heavily leveraged, engaging in risky lending practices, particularly in the mortgage market. The collapse forced a massive deleveraging process, where banks wrote off bad debts, restructured, and received government bailouts.

Without that crisis moment:

Banks might have continued their reckless lending, inflating an even bigger financial bubble. Mortgage-backed securities and risky derivatives could have persisted, making the eventual reckoning even worse. The government may not have been forced to enact the financial regulations that followed the crisis, such as Dodd-Frank, potentially leaving the system vulnerable to future instability. Essentially, avoiding the GFC might have just kicked the can down the road, setting up an even bigger financial disaster later.

Conclusion: Would It Have Been Better Without the GFC?

At first glance, avoiding the 2008 financial crisis sounds like a positive outcome—no bank bailouts, no Wall Street panic, no deep recession. But in reality, the U.S. economy was already in trouble before the banking system collapsed.

Without the GFC, we likely would have suffered through a different kind of economic pain—one that looked more like the 1970s stagflation than the sharp, deflationary crisis of 2008-2009.

High inflation would have lingered. The Fed would have had fewer tools to stimulate growth. The recession might have been more prolonged and grinding. A bigger financial bubble could have emerged, setting up an even larger crash in the 2010s. Ultimately, while the 2008 financial crisis was painful, it forced a reckoning that may have prevented an even bigger disaster later. The system was unsustainable, and a correction was inevitable. Whether it happened through a slow stagflationary decline or a sharp financial meltdown, the U.S. economy was going to face serious consequences either way.

In the end, history played out as it did. But it’s worth considering: would you rather endure a slow-burning economic downturn with stubborn inflation, or rip off the Band-Aid with a quick but devastating financial collapse?

Which crisis would you have chosen?

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55124/79bc18fa-f616-4951-856f-cc724ad5d497-560x416.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55099/2638a982-b4de-4913-8a1c-1479df352bf3-560x416.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55136/b1b0b614-5b72-486c-901d-ff244549d67a-350x260.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55124/79bc18fa-f616-4951-856f-cc724ad5d497-350x260.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55099/2638a982-b4de-4913-8a1c-1479df352bf3-350x260.webp)