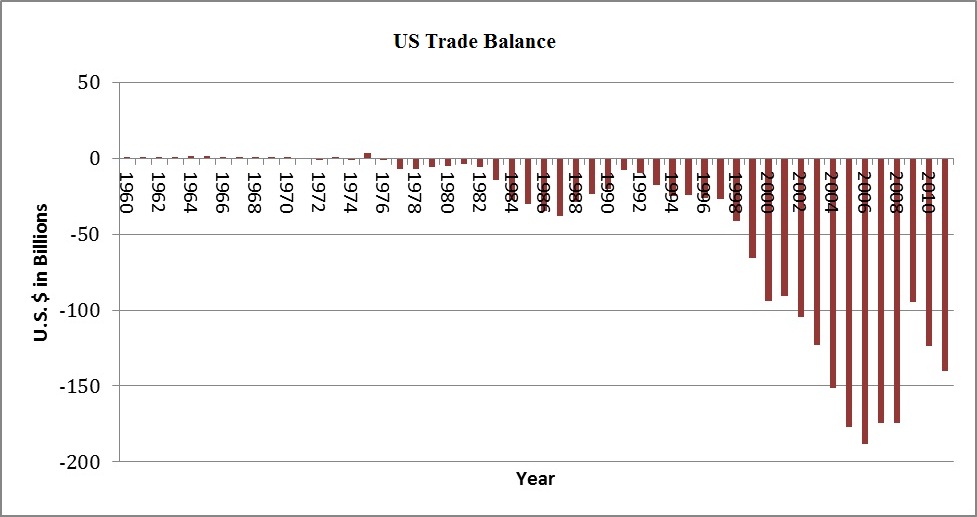

The United States has run a large trade deficit since the 1980s and since the country is – still – the largest economy in the world, this fact does not only have domestic implications for the US but also affects the world economy in a rather significant manner.

The US has gone from being the world’s largest creditor to the world’s largest debtor. As accounting identities require, the trade deficit had to be financed by borrowing from abroad.

So what is the cause of the US trade deficit? That seemingly simple question is to be proven both as diverse as it is interesting to answer.

Causation

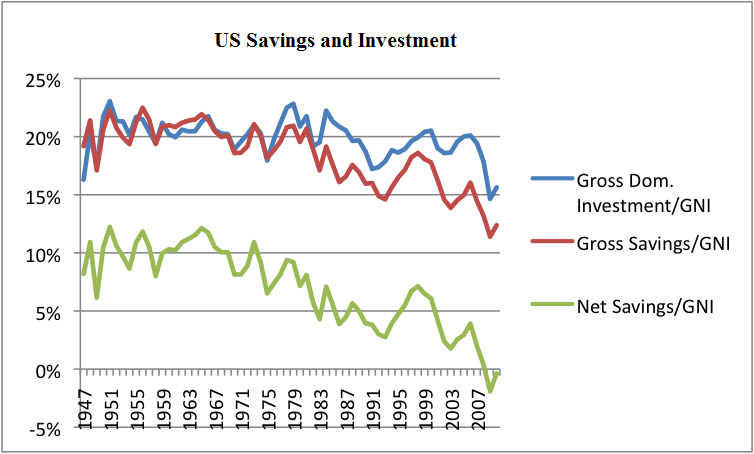

Savings and investments are essential to this broad analysis, as trade balance equals net capital outflow or inflow, it also equals savings minus investments.

This fact is even more important for small open economies with small or negligible effects on world interest rates. These small open economies have free and perfect capital mobility, which constitutes a domestic interest rate that equals the world interest rate.

Without going into too much detail to derive equations, here follows a summary of what the above implies:

Where output is given by the production function, and consumption is related to disposable income, investments related to real interest rate, this gives us a simple equation that looks like NX=S-I or NX = S – I(r*).

That is, the trade balance is determined by the difference between saving and investment at the world interest rate. And when savings fails to compensate for investment, capital is borrowed from abroad and vice versa. Also, the real exchange rate is related to net exports, NX = NX (E), where the trade balance equals net capital outflow, which equals savings minus investments.

US Trade History

In the 1980s US national savings fell due to expansionary fiscal policy, with cuts in income taxes without equal cuts in government spending, resulting in a budget deficit. It was a relatively large trade deficit at the time. And as the deficit reduced national savings, it thereby caused a trade deficit.

Later, in the 1990s the US federal government got its fiscal house in order via mainly increasing taxes, but also cuts in government spending. The US also experienced high productivity growth during the 1990s, raising incomes, and increasing tax revenues.

With a budget deficit going into a surplus, and with increased national savings, the trade deficit should decline you might think. After all, that would follow the logic outlined above.

But as the statistics show, it didn’t, and the reason for this is as the statistics also show that investments increased. As the 90s was the era of the information technology boom, with Silicon Valley, the internet, the semiconductor industry, and computers – very much a US-led industry and a world-changing event. This boom caused an expansionary shift in the US investment function. With capital flowing into the US economy.

In the early 2000s, there was once again a decrease in domestic savings, created by tax cuts and ever more expensive military operations abroad, in the wake of the September 11th attacks and following wars. This caused a federal budget deficit and a lower savings rate, which constitutes a trade deficit.

Scenarios and Marginal Productivity

From a hypothetical scenario where the US was to be unable to borrow on world markets to finance the deficit, there would be a massive excess supply of US dollars on the world market, collapsing the external value of the dollar.

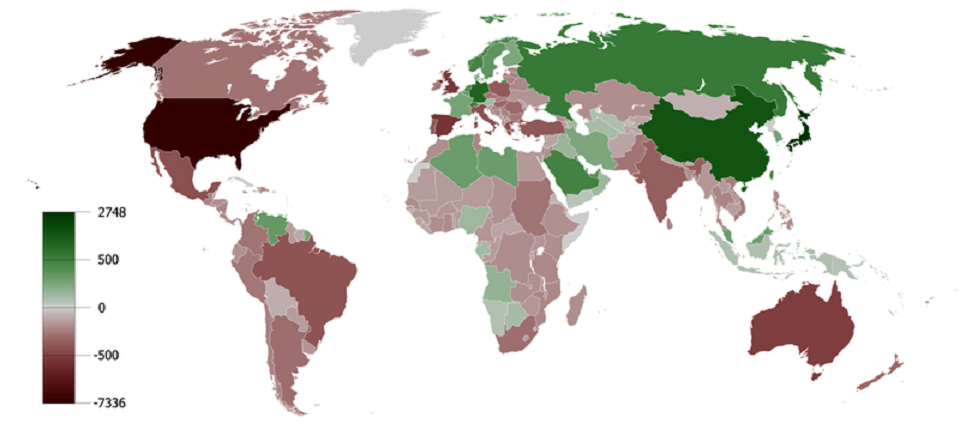

A valid question to ask is why the flow of capital does not reverse. In a broader context, after all, the marginal productivity of capital (partial derivative with respect to the capital of the production function) is considerably higher in the US than many of the countries that are borrowing to the US, countries such as China and Russia.

The logic of diminishing marginal product follows that capital is more valuable where it is scarce. So why does not capital flow to poorer countries? Instead of flowing to e.g. Europe, the US, Japan, and South Korea.

Well, the answer is due to many complicated variables, both economic and political. Risk is essential for investments. And general stability, political stability, political and institutional maturity, law and order (property rights), corruption – all act as relevant aspects to consider for private investments.

Also, technology, human capital (education), and production capacity (variable A) also contribute to making capital less valuable in poorer countries.

The Future?

The models provide us with the logic behind it, but they do not outline the future and what a chronic deficit could and would imply.

There is a consensus among economists that a chronic trade deficit is negative, but the consensus ends there. There are many differences in opinion with respect to some key aspects.

The Nobel Prize winner Paul Krugman outlines that perhaps a worst-case scenario, with a risk of sudden capital flight would go as follows:

“The traditional immunity of advanced countries like America to third-world-style financial crises isn’t a birthright. Financial markets give us the benefit of the doubt only because they believe in our political maturity — in the willingness of our leaders to do what is necessary to rein in deficits, paying a political cost if necessary…. If this kind of fecklessness goes on, investors will eventually conclude that America has turned into a third-world country, and start to treat it like one. And the results for the US economy won’t be pretty.”

Economics professor Gregory Mankiw does not see the trade deficit as a problem by itself, but rather as a symptom of a problem. Where the real problem is low national savings. And since national savings is low, he argues that he is not eager for the trade deficit to disappear. Since this implies that domestic investments would need to fall to the low level of national savings.

But Mankiw and indeed a majority of economists think that it would be a good thing if the trade deficit diminished if accompanied by an increase in national savings.

From a Global Perspective: Trade Deficit and Comparative Advantage

In an even broader world context of trade, investments provide marginal product increases, and in the long run change trade patterns (intra-industry, inter-industry trade, Krugman, and Ricardian analysis). We recommend the below-published article on the emergence of China as an economic superpower, and what it implies for world trade.

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55124/79bc18fa-f616-4951-856f-cc724ad5d497-560x416.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55099/2638a982-b4de-4913-8a1c-1479df352bf3-560x416.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55136/b1b0b614-5b72-486c-901d-ff244549d67a-350x260.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55124/79bc18fa-f616-4951-856f-cc724ad5d497-350x260.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55099/2638a982-b4de-4913-8a1c-1479df352bf3-350x260.webp)