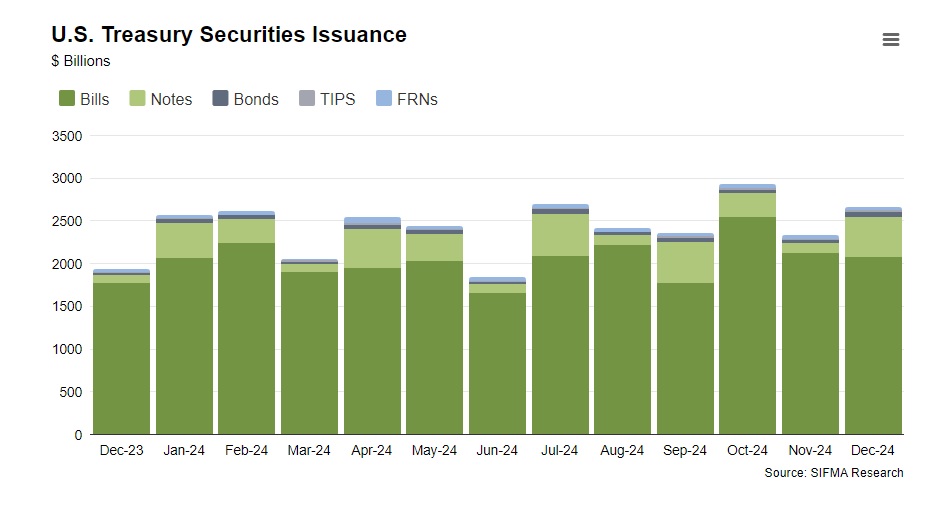

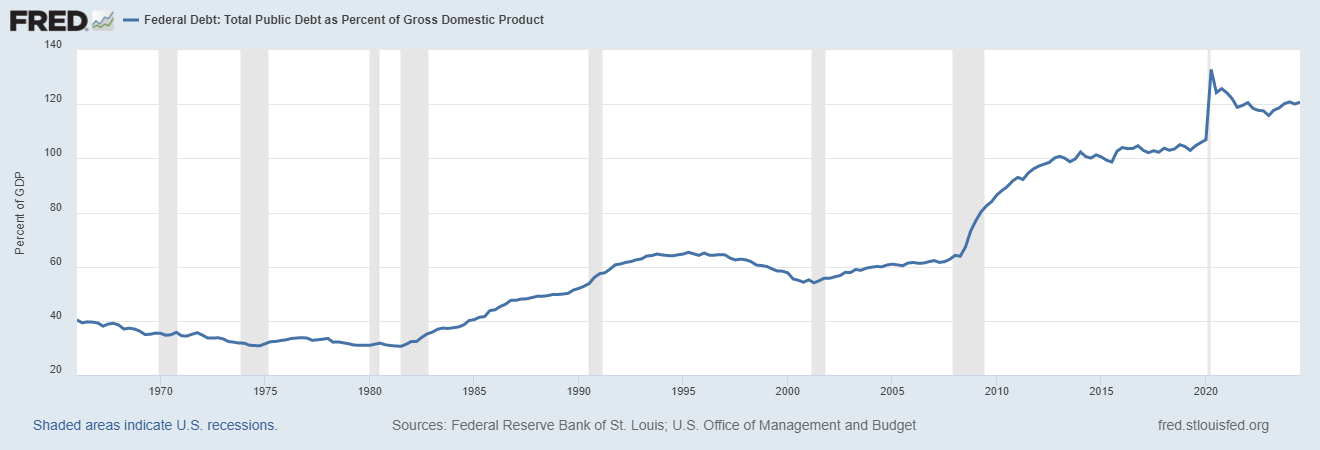

In recent years, the U.S. Treasury has relied heavily on short-term debt instruments, such as Treasury bills (T-bills) and short-duration Treasury notes, to finance growing federal deficits. While this strategy mitigates immediate borrowing costs and supports market stability, it carries significant long-term risks. The reliance on short-term debt has implications for inflation dynamics, fiscal sustainability, and monetary policy, highlighting the delicate balance policymakers must maintain to avoid fiscal dominance and market dysfunction.

The Rise of Short-Term Debt

A Strategic Choice

The U.S. Treasury, under Treasury Secretary Janet Yellen and her predecessor, has issued large amounts of short-term debt in response to the twin pressures of rising federal deficits and an evolving interest rate environment. This approach reflects a pragmatic response to several constraints:

Avoiding Long-Term Costs: Issuing long-duration bonds at higher interest rates would lock in elevated borrowing costs for decades. Short-term debt offers lower immediate yields, making it a more cost-effective option.

Maintaining Market Functionality: Flooding the market with long-term bonds could overwhelm demand, driving up yields on benchmark 10-year Treasuries and risking dysfunction in the Treasury market, which underpins global financial stability.

Meeting Demand for Liquidity: Short-term securities are highly liquid and in demand by institutional investors, including money market funds and banks. This robust demand supports market stability and ensures the Treasury’s funding needs are met.

Analysts have highlighted the U.S. Treasury’s increased dependence on short-term debt to finance the expanding budget deficit. Projections indicated that the total outstanding stock of T-bills would reach an all-time high of $6.2 trillion by the end of 2024, up from $5.7 trillion at the end of 2023.

Money-Like Properties and Inflation Risks

Are Short-Term Treasuries Inflationary?

Short-term Treasury debt exhibits money-like qualities due to its liquidity, safety, and widespread use in financial markets. These characteristics raise concerns about its potential to contribute to inflation in several ways:

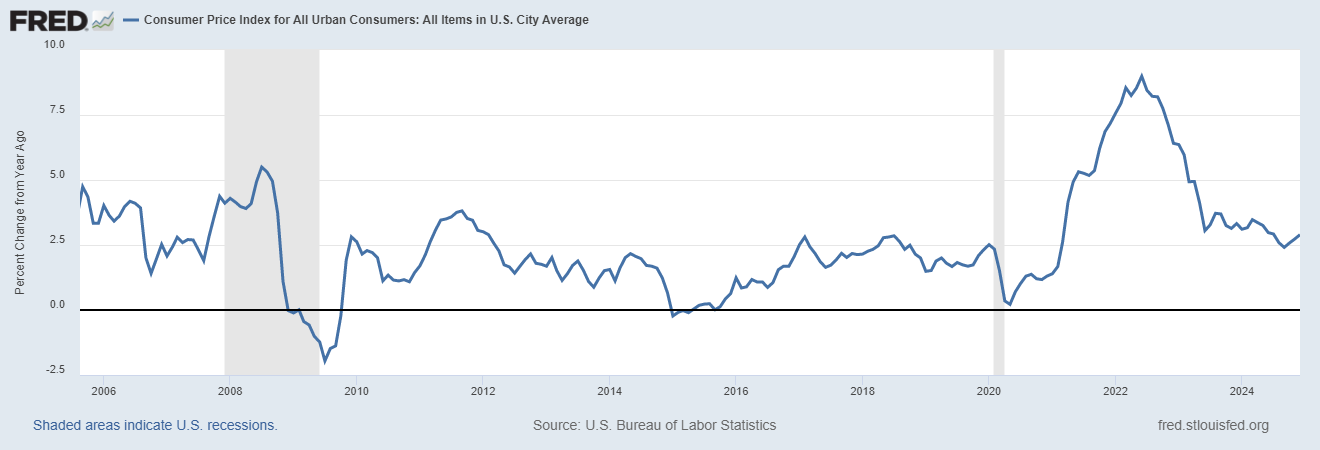

Liquidity Injection: The issuance of short-term securities injects liquidity into the financial system, which can indirectly fuel credit creation and economic activity, creating inflationary pressures.

Debt Monetization: When the Federal Reserve purchases short-term Treasuries, it directly increases the money supply, amplifying inflation risks.

Sustaining Demand: High levels of short-term debt issuance may enable persistent government spending, sustaining aggregate demand and keeping inflation elevated.

Sticky Inflation and Fiscal Dominance

The Risk of Fiscal Dominance

Reliance on short-term debt increases the likelihood of fiscal dominance, where fiscal policy constraints overshadow the central bank’s ability to control inflation. This dynamic can result in sticky inflation, as observed in the following scenarios:

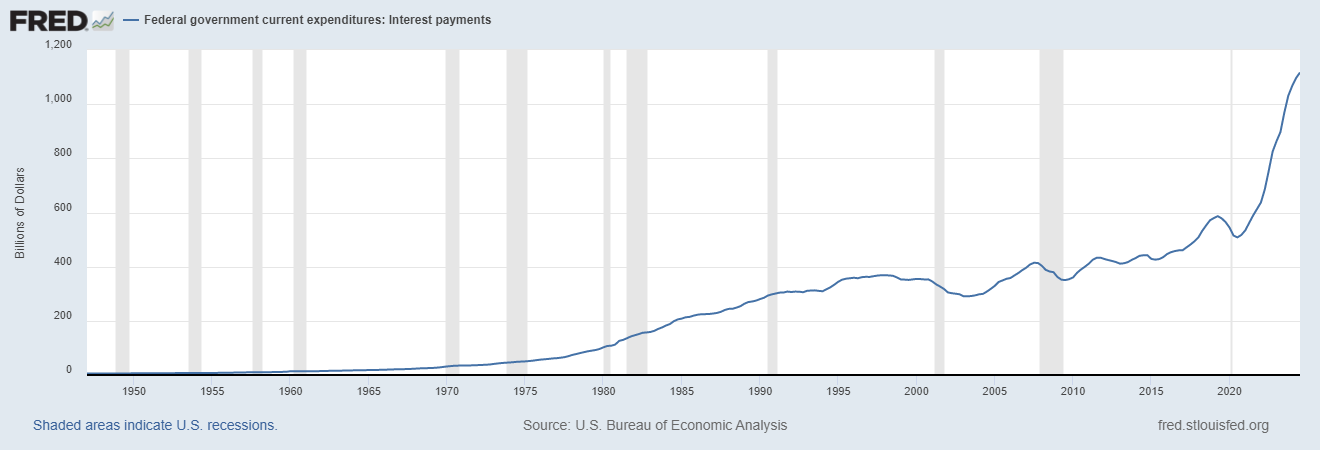

Central Bank Pressures: Frequent refinancing of short-term debt ties the government’s borrowing costs closely to prevailing interest rates. Higher rates quickly translate into higher debt servicing costs, potentially pressuring the Federal Reserve to avoid aggressive rate hikes.

Sustained Deficits: Short-term debt issuance allows the government to defer fiscal tightening. Continued deficits, financed through liquid securities, sustain demand-side pressures that exacerbate inflation.

Entrenched Inflation Expectations: Fiscal dominance limits the effectiveness of monetary policy. If inflation expectations rise, they may become entrenched, making inflation harder to control without extreme measures.

Historical and Contemporary Context

Lessons from the Past

Historical episodes, such as the inflationary period of the 1970s, illustrate the risks of fiscal dominance. In that era, central banks were constrained by fiscal pressures, leading to sustained high inflation until aggressive rate hikes in the early 1980s restored monetary control.

The Modern Era

Today, with record-high deficits and rising interest rates, the U.S. faces renewed fiscal dominance risks. Short-term debt issuance, while mitigating immediate market stresses, amplifies long-term challenges:

Refinancing Risks: Frequent rollovers expose the government to interest rate volatility, potentially leading to spiraling debt costs in an inflationary environment.

Market Stability: Sustained high issuance of short-term securities could strain money markets, especially if demand falters.

Monetary-Fiscal Interaction: The Federal Reserve’s efforts to control inflation through quantitative tightening and rate hikes may be undermined by high liquidity from short-term debt issuance.

Why Policymakers Had Little Choice

The Treasury’s reliance on short-term debt is not a sign of poor judgment but a reflection of the limited options available:

Managing Immediate Costs: With deficits at historic highs, short-term debt offers a way to finance government spending at the lowest possible cost.

Avoiding Market Dysfunction: Issuing large amounts of long-term debt could disrupt Treasury markets, spiking yields and creating broader financial instability.

Navigating Uncertainty: Short-term debt provides flexibility to adapt to changing economic conditions, especially in a volatile interest rate environment.

Conclusion

The U.S. Treasury’s strategy of issuing significant amounts of short-term debt reflects the complexities of balancing fiscal and monetary priorities in a high-deficit, high-inflation world. While this approach mitigates immediate borrowing costs and market risks, it increases exposure to refinancing risks, inflationary pressures, and fiscal dominance concerns. Policymakers must tread carefully to ensure that short-term expedience does not compromise long-term fiscal and economic stability. The ultimate challenge lies in maintaining the delicate equilibrium between addressing today’s fiscal needs and safeguarding the economy’s future health.

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55124/79bc18fa-f616-4951-856f-cc724ad5d497-560x416.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55136/b1b0b614-5b72-486c-901d-ff244549d67a-350x260.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55124/79bc18fa-f616-4951-856f-cc724ad5d497-350x260.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55099/2638a982-b4de-4913-8a1c-1479df352bf3-350x260.webp)