Introduction: The End of an Era

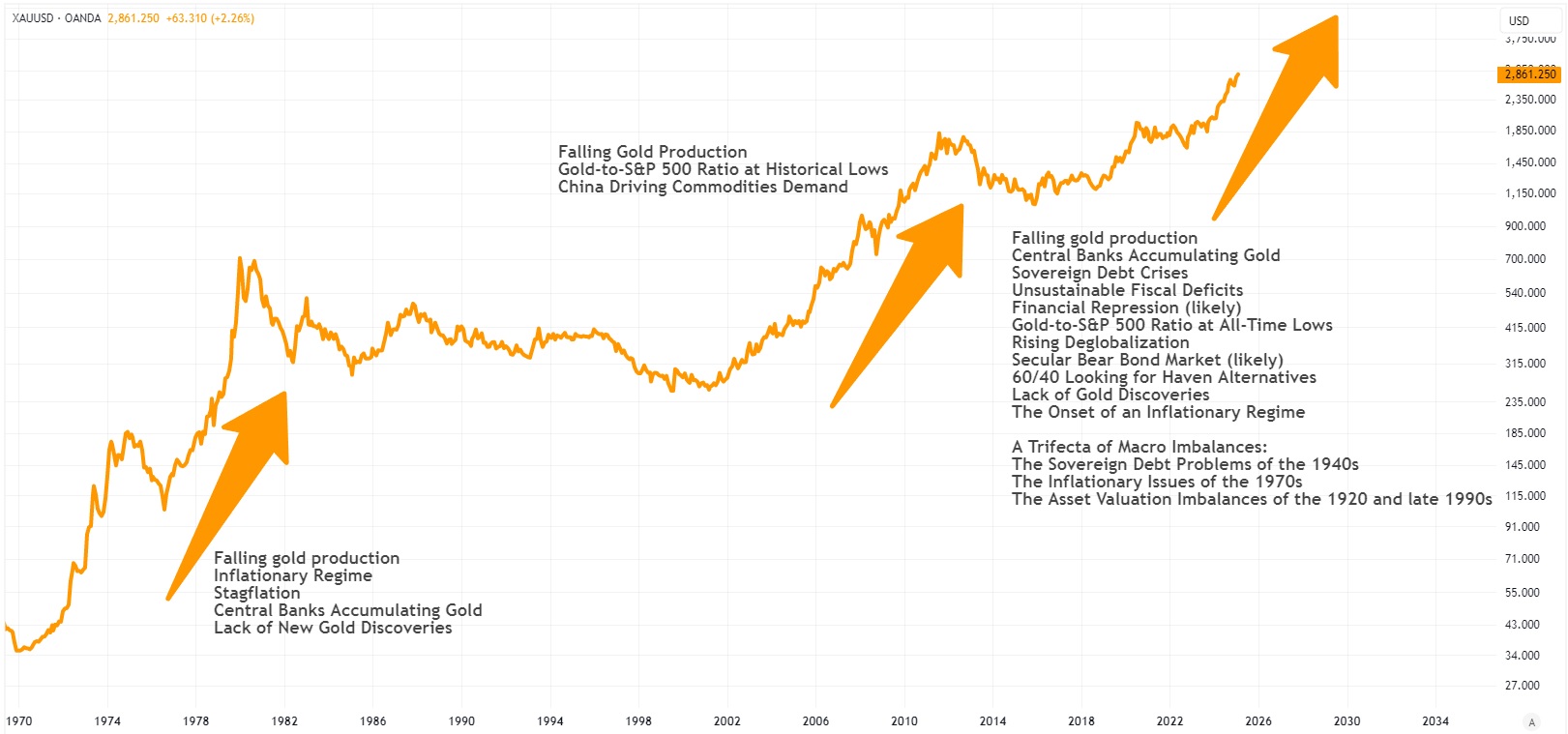

The global financial system is undergoing a profound transformation, one that echoes historical shifts seen in the 1930s, 1970s, and early 2000s. The era of U.S. Treasuries as the undisputed premier reserve asset is waning, and a new capital rotation is emerging—one that favors gold, commodities, and real assets. This transformation is being driven by deglobalization, sovereign debt crises, secularly higher interest rates, and a growing distrust in the dollar-based financial system.

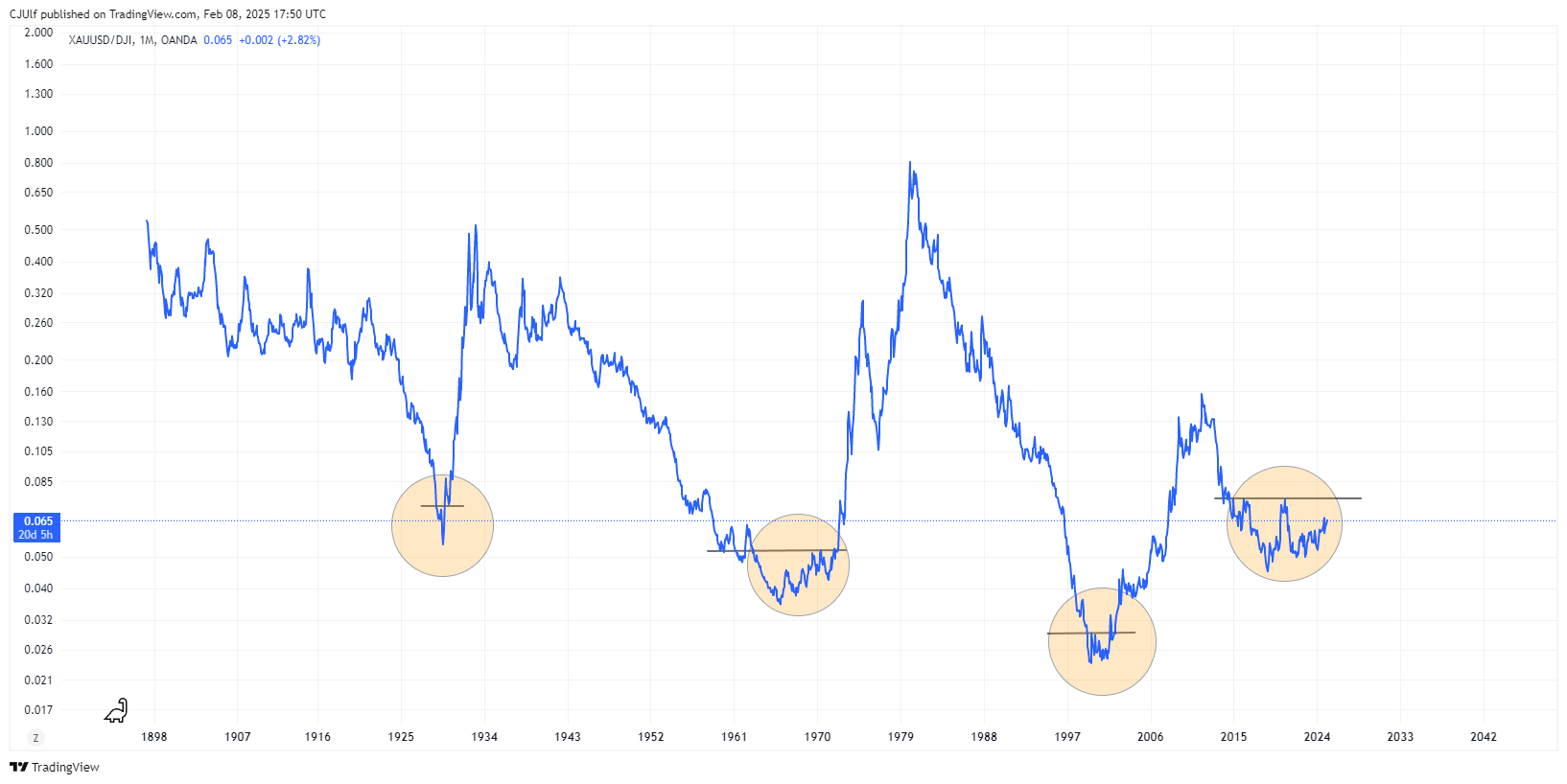

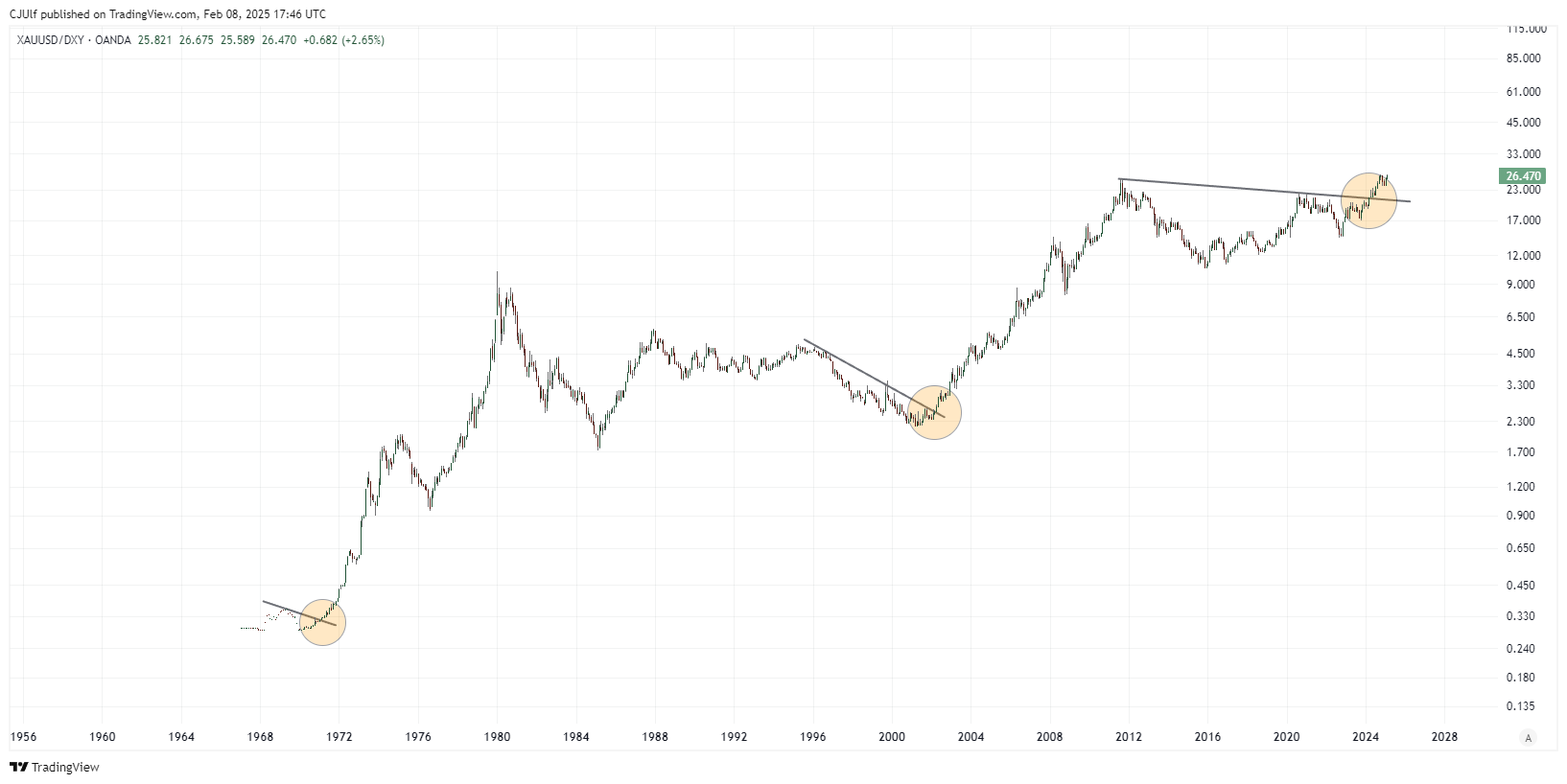

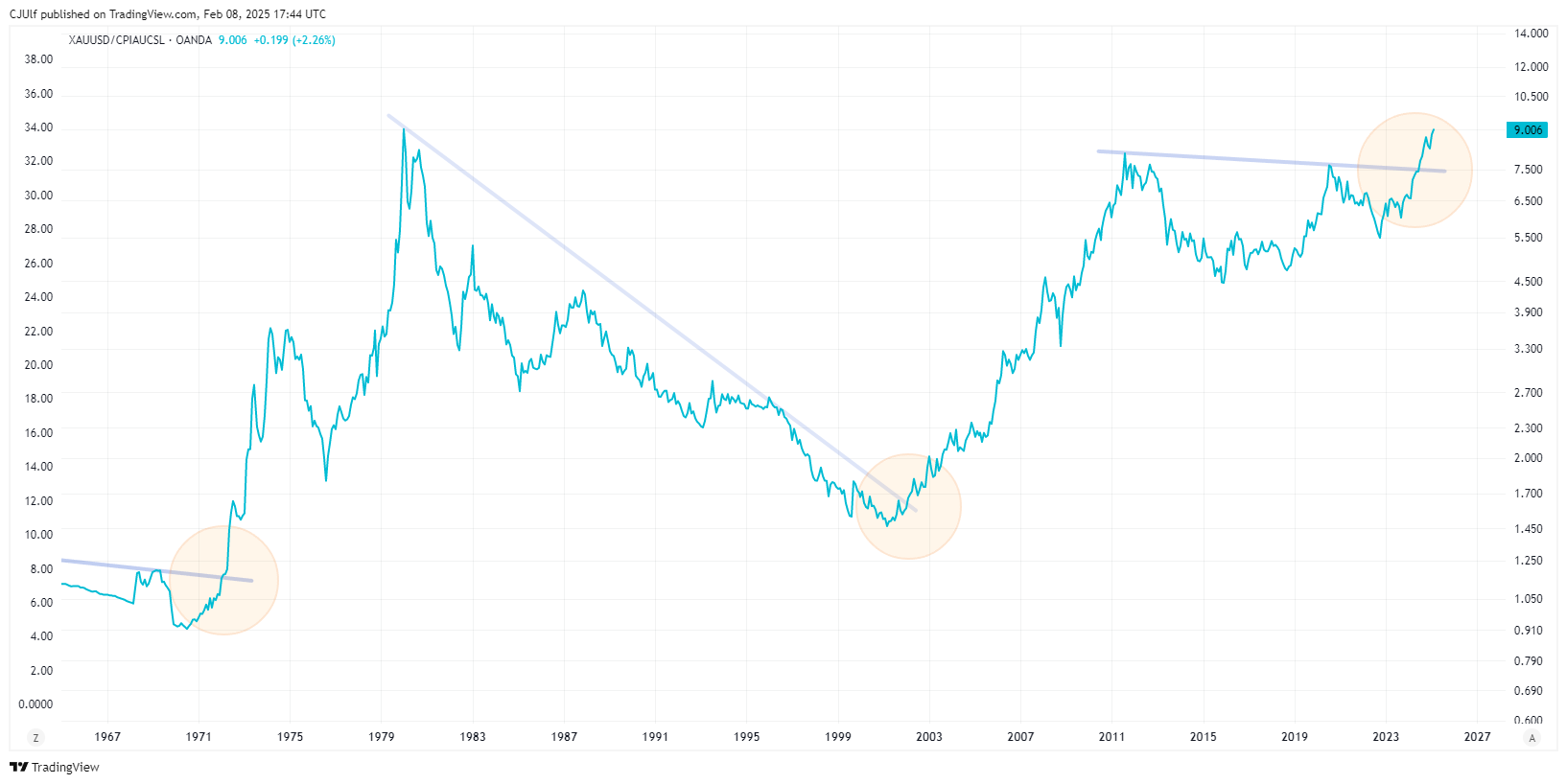

The process began in earnest in 2014 and accelerated in 2022, fueled by geopolitical fractures, unsustainable fiscal policies, and the realization that sovereign debt levels have reached a breaking point. More recently, gold has been breaking out against key economic indicators such as U.S. CPI, U.S. M2, and major stock indices—signaling a fundamental shift reminiscent of the dot-com bust in 2000. This article explores the key drivers of this paradigm shift and its implications for global finance.

Deglobalization and the Manufacturing Revitalization Trend

The End of the Globalization Boom

From the 1990s to the early 2010s, globalization drove capital into financial assets, particularly technology and growth stocks. However, this trend is reversing. Supply chain vulnerabilities, geopolitical tensions, and national security concerns have led major economies, especially the G-7, to prioritize domestic production. This manufacturing revitalization is evident in the U.S., Europe, and parts of Asia, with massive investments in semiconductor production, defense industries, and energy infrastructure.

Impact on Capital Flows:

• Capital is shifting away from globalized, low-cost production toward domestic industries that ensure strategic autonomy.

• Industrial, energy, and commodities sectors are benefiting at the expense of overvalued financial assets.

• Inflationary pressures are mounting as production costs rise due to reshoring efforts.

This shift favors real assets, particularly commodities, gold, and resource-rich economies.

The Sovereign Debt Crisis and Financial Repression

Extreme Sovereign Debt Levels: The Breaking Point

With global debt-to-GDP ratios at all-time highs, the ability of governments to finance deficits without triggering inflation is diminishing. The U.S. fiscal deficit exceeded $2 trillion in 2023, with interest payments on debt becoming a dominant budgetary expense. Similar fiscal strains exist in Europe and Japan.

What Happens Next?

• Governments will either default, inflate away debt, or engage in financial repression—suppressing interest rates below inflation to erode the debt burden over time.

• Yield curve control (YCC) may be reintroduced, forcing bond yields artificially low.

• Savers and bondholders will be penalized as real yields remain negative.

Financial Repression: The Silent Default

Financial repression occurs when governments manipulate financial markets to suppress borrowing costs and inflate away debt. This often includes:

• Capping bond yields below inflation (yield curve control).

• Mandating pension funds and banks to hold government debt.

• Restricting capital flows to prevent flight from fiat currencies.

• Inflationary monetary policy that erodes the real value of savings.

This process means that holding bonds becomes an unviable long-term strategy, pushing capital into real assets like gold and commodities.

The Rise of Gold as the Premier Reserve Asset

The Weaponization of the Dollar

In 2022, the U.S. froze $300 billion of Russia’s foreign reserves, demonstrating that U.S. Treasuries are no longer a politically neutral asset. This event triggered a wave of de-dollarization, particularly among BRICS nations and emerging markets, which now seek alternatives to dollar-based reserves.

Central Banks Are Buying Gold at Record Levels

Since 2014, China and Russia have been aggressively reducing their U.S. Treasury holdings while accumulating gold. The trend accelerated post-2022, with central banks purchasing over 1,000 metric tons of gold annually—the highest in recorded history.

Key Evidence of the Shift:

• China’s U.S. Treasury holdings fell from $1.3 trillion in 2014 to below $800 billion in 2024.

• Russia eliminated its U.S. Treasury holdings in 2018 and now holds over 2,300 tons of gold.

• Turkey, India, and the UAE have increased gold reserves at an unprecedented pace.

Gold vs. U.S. Treasuries: The New Reserve Hierarchy

Gold has several advantages over Treasuries in the new paradigm:

• No Counterparty Risk: Unlike Treasuries, gold cannot be seized or frozen by foreign governments.

• True Store of Value: Gold has outperformed fiat currencies during debt crises and inflationary periods.

• Limited Supply Growth: Unlike fiat money, gold supply grows at just 1.5% per year, making it a superior hedge against monetary debasement.

As foreign central banks continue rotating out of U.S. Treasuries and into gold, the process of gold replacing Treasuries as the premier reserve asset is well underway. The USD gold price (XAUUSD) has decupled from its correlation to the US 10 year Treasury real rate since 2022.

The Death of the 60/40 Portfolio and the Rise of Real Assets

Why the 60/40 Model No Longer Works

For decades, a traditional 60/40 portfolio (60% equities, 40% bonds) provided investors with stability. Falling interest rates from 1981 to 2021 created a golden age for bonds, making them an effective hedge against equities. However, this model is breaking down due to:

• Higher structural inflation eroding bond values.

• Sovereign debt risks making bonds an unreliable “safe” asset.

• Negative real yields forcing capital into alternative stores of value.

The Shift Toward Real Assets

As bonds lose their defensive role, capital is shifting into:

1) Gold & Precious Metals – Protection against monetary debasement.

2) Commodities (Oil, Uranium, Copper) – Real assets that thrive in inflationary environments.

3) Infrastructure & Energy – Beneficiaries of government spending and reshoring efforts.

4) Dividend-Paying Equities – Companies with pricing power and real cash flows.

5) Select Emerging Markets – Resource-rich economies benefiting from the deglobalization trend.

Conclusion: A Global Monetary Reset in Motion

We are witnessing a paradigm shift in global capital allocation. The dominance of financial assets—particularly U.S. Treasuries—is fading, while gold, commodities, and real assets are reclaiming their historic role as primary stores of value.

This transformation is being driven by unsustainable sovereign debt, financial repression, deglobalization, and geopolitical realignments. While the process is gradual, it is accelerating, and the endgame could involve a formal gold revaluation or a multipolar reserve system with gold playing a central role.

For investors and policymakers, the key takeaway is clear: we are entering an era where real assets, not financial instruments, will drive wealth preservation and growth. The capital rotation has already begun—those who recognize it early will have the advantage.

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55099/2638a982-b4de-4913-8a1c-1479df352bf3-560x416.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55136/b1b0b614-5b72-486c-901d-ff244549d67a-350x260.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55124/79bc18fa-f616-4951-856f-cc724ad5d497-350x260.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55099/2638a982-b4de-4913-8a1c-1479df352bf3-350x260.webp)