If the equity market is the wild child who disregards authority and endangers himself because of naiveté, then the bond market is the responsible adult that utilizes knowledge and wisdom accumulated over a lifetime of hard-learned lessons. Today, the bond market is imploring us to pay attention, but for one reason or another, the market seems to disregard it or misunderstand it.

The Federal Reserve announced higher interest rates in 2023 during last week’s FOMC meeting. In response, bond yields first increased, to later decline. Bonds are anchored in reality and tell us the truth – it’s telling us something now and we should listen. It’s telling us that inflation peaked out a while ago and that growth is about to decline.

By definition, a recession is a decline in output, or GDP growth, over two successive quarters. The evidence of a recession is seen in a decline in industrial output and trade. When the value of the dollar is expected to be lower in the future, the price of the bond falls and the interest rate on the bond rises. When the value of the dollar is expected to be higher in the future, the price of the bond rises and the interest rate on the bond falls.

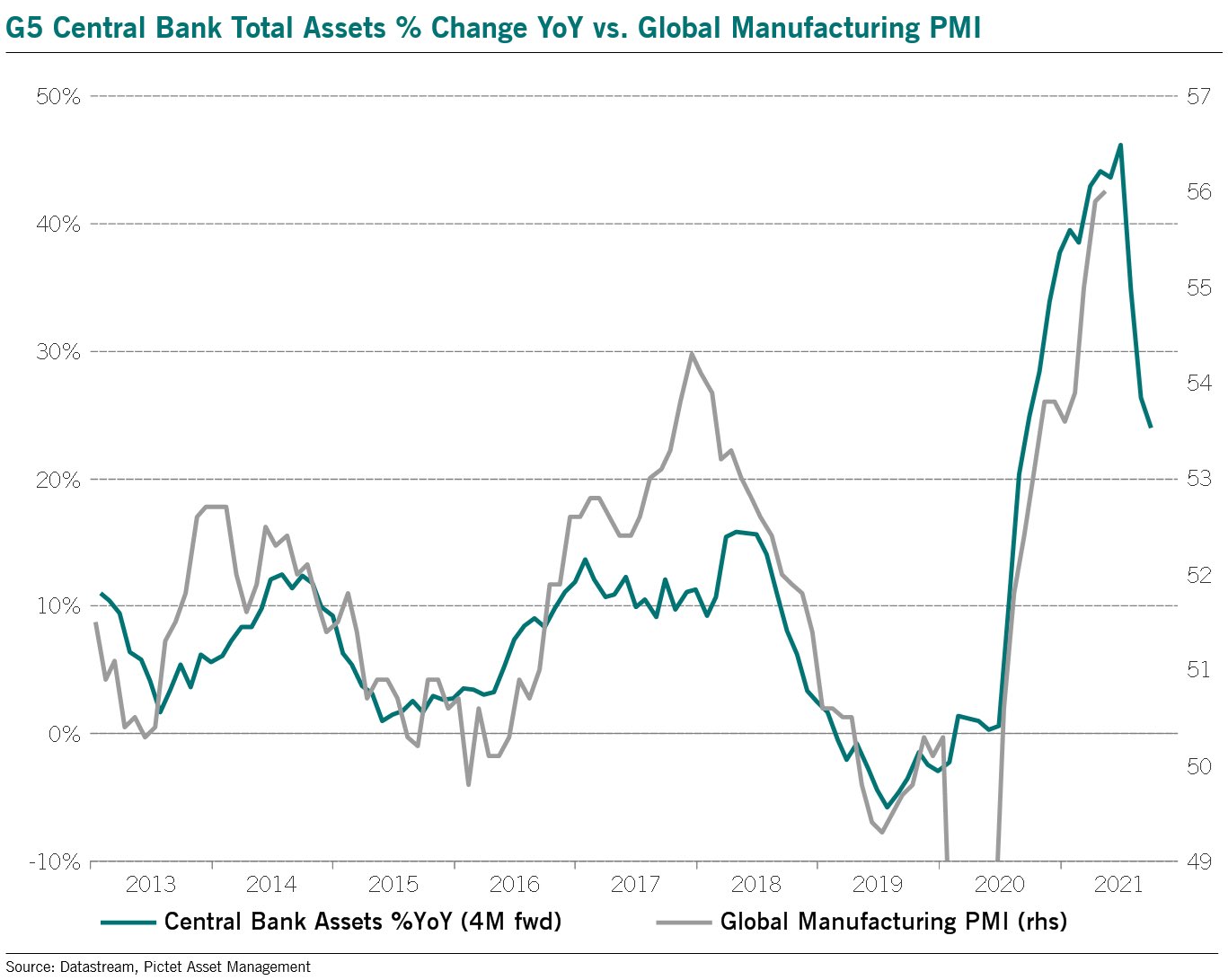

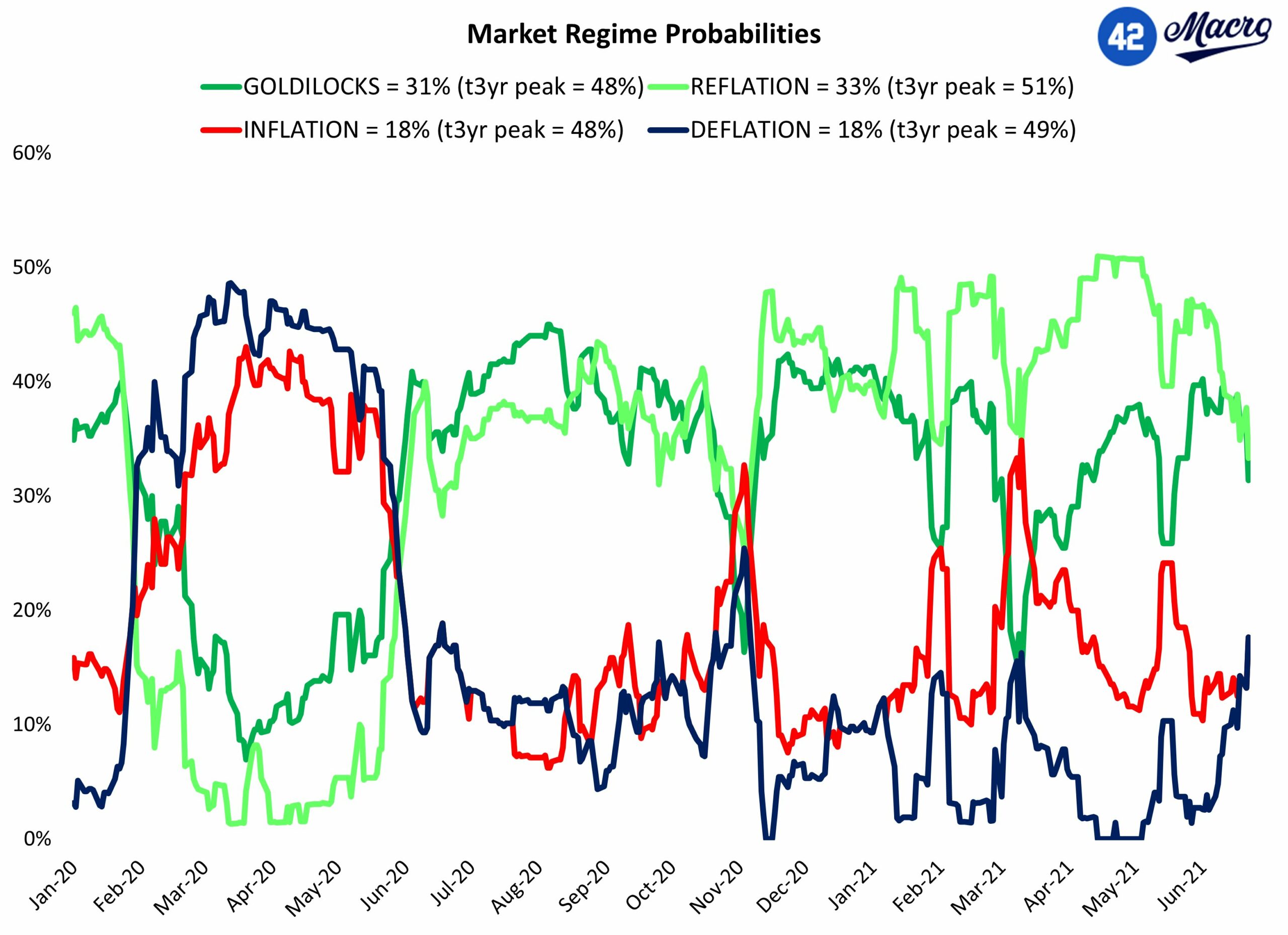

We have all seen Year-on-Year inflation going up during the first half of this year, this is mainly due to base effects stemming from the fact that the economy was locked down a year ago. The narrative for the first half of the year has been inflation and reflation – with growth going up. At the same time, the FED has continually claimed that the increasing inflation is transitory.

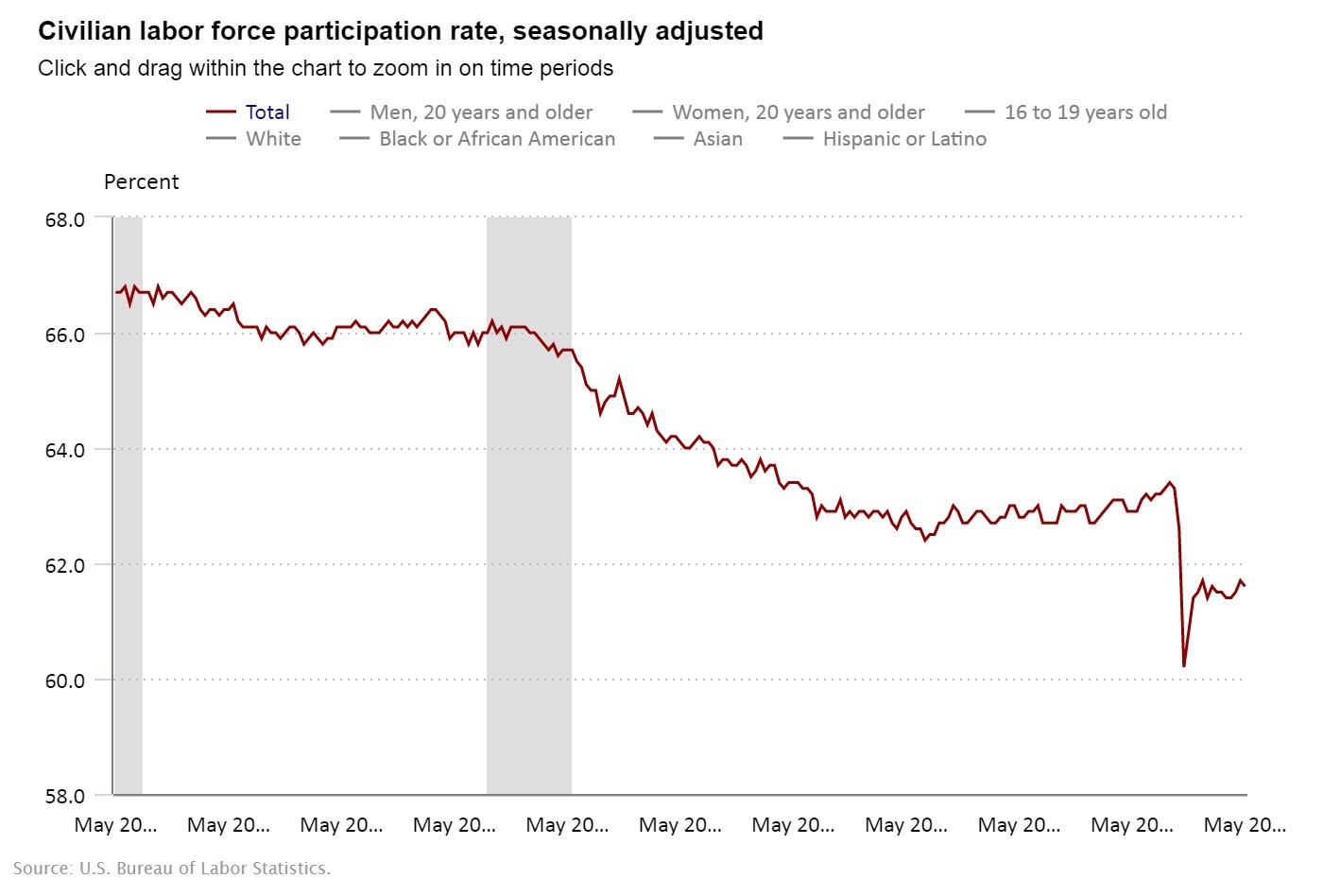

But is the reflation narrative really true? Is the FED actually correct? What we are seeing now is that the global economy is beginning to display signs of secular decline. The labor participation rate in the U.S., in particular, remains low and has leveled off since the reopening – the chart is looking like a square root sign.

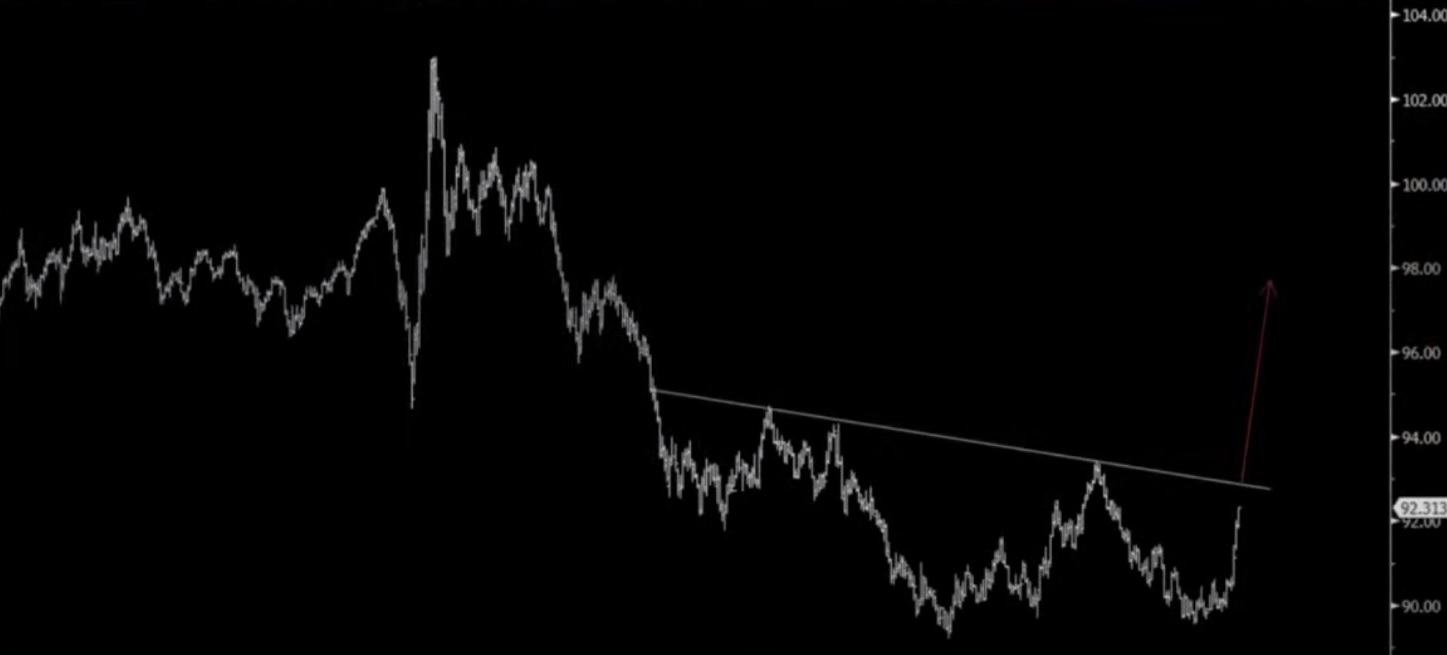

The DXY has begun rising again since last week. The dollar is the key macro variable, everything is priced in dollars. If the dollar goes up, commodities go down – it’s the inverse denominator. It appears as if the reflation narrative is getting unwind. We see it in lumber and in AGS. It is not happening in oil, perhaps in copper.

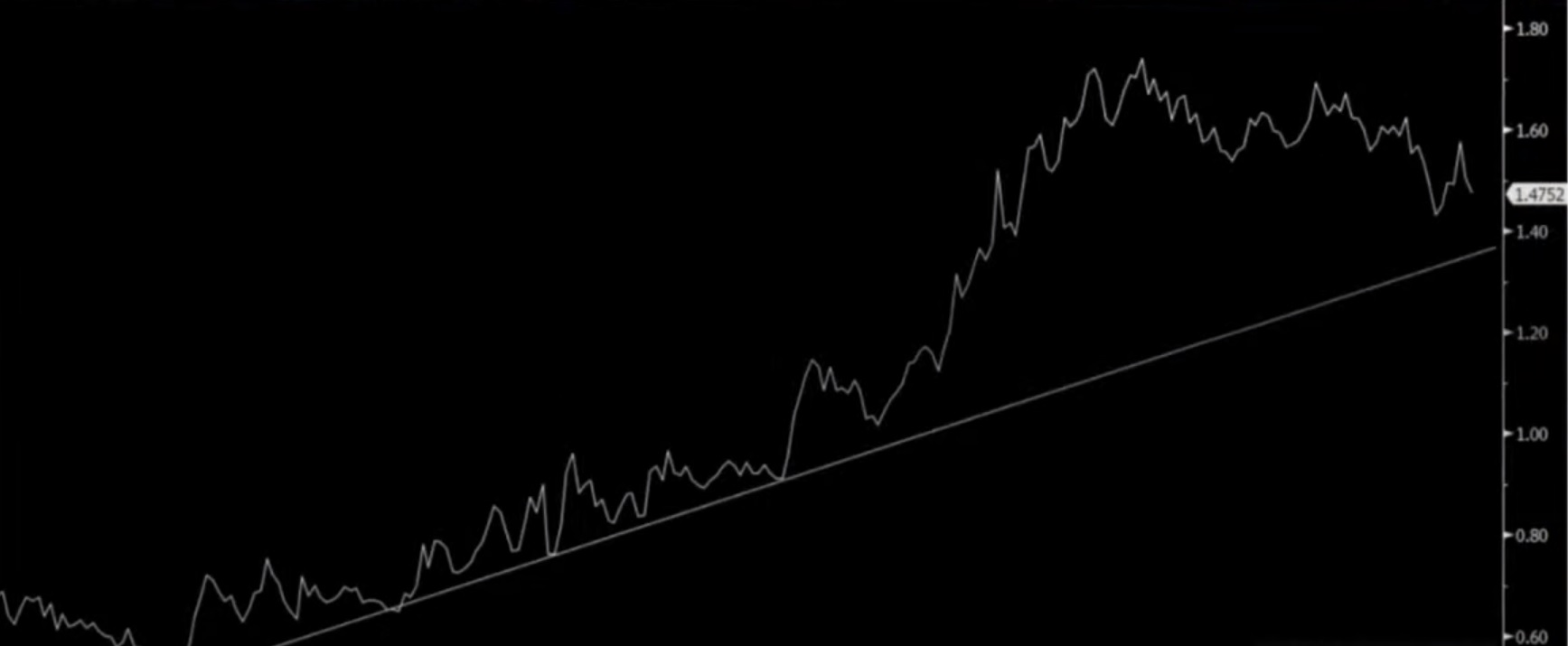

The 10-year bond yield spiked back in March and has been coming off since. Now, we are starting to get to the key level around 1.40 and if we break that trend line, the likelihood is that we are getting back to the lows. If we are seeing reflation and economic growth, you would expect to see interest rates rise.

In every single post-recession period since 1962, bond yields have had a sharp squeeze as everyone has tried to price in inflation and they are most often too early. Usually, this is just a rebound effect. Then stimulus, whether from the central bank cutting rates, or quantitative easing, or fiscal stimulus from the government tends to falter and the central banks have come out and cut rates two more times at least after the recession finished and bond yields fall.

The dollar actually tends to go up when bond yields fall. This is counterintuitive and the reason for this is that the dollar is a safe haven and if things look like the world is slowing down then money tends to flow into dollars. The increase in the dollar lowers inflation. It’s a feedback loop that drives the dollar higher and rates lower.

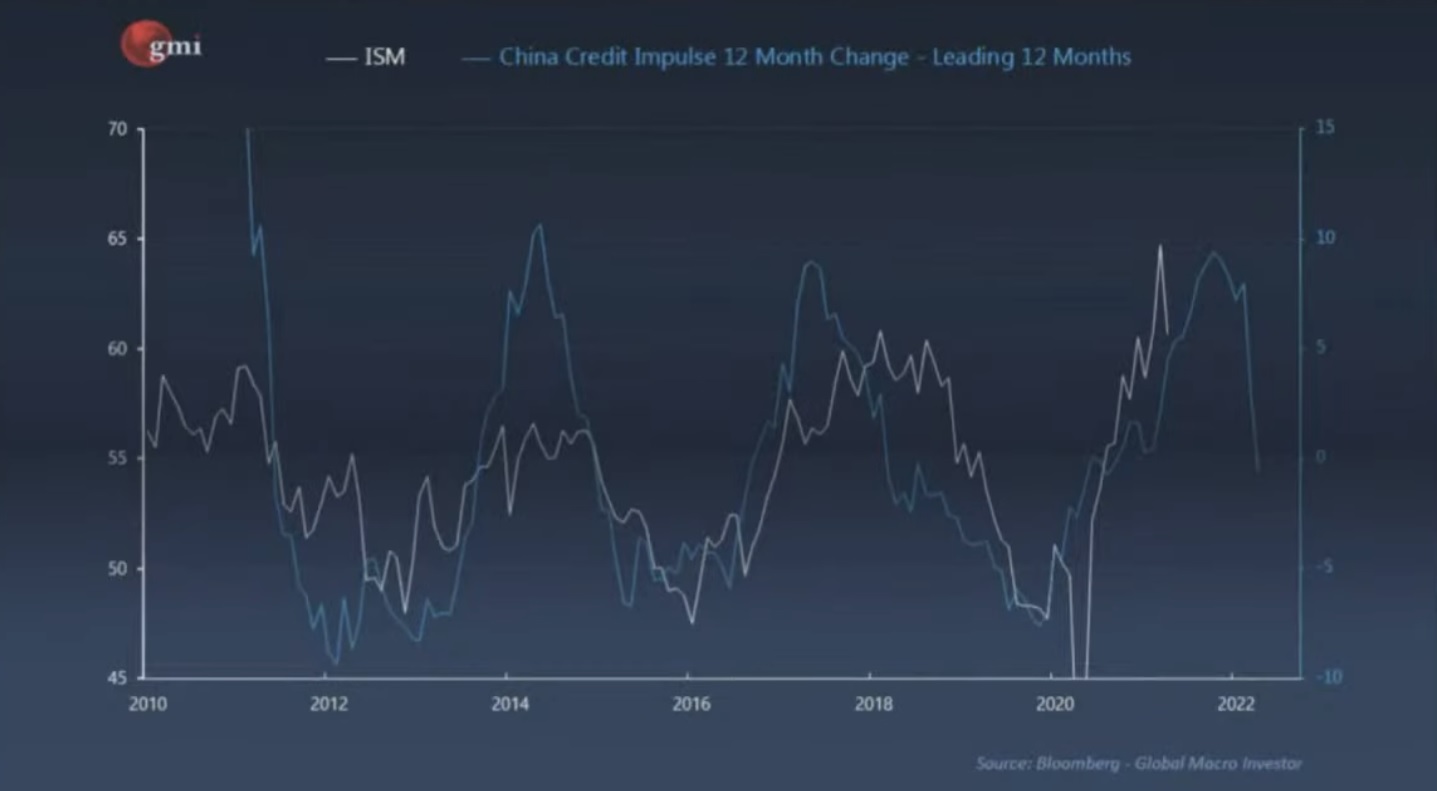

More proof of this is that the Chinese business cycle appears to have turned negative. Below is the Chinese credit impulse, a forward-looking indicator and a good indicator of the business cycle. The US business cycle and the world business cycle tend to follow after.

Hence, after a recession, we get the initial sugar rush, and then everything tends to slow down again. This is usually when the usual suspects start stimulating more. It looks like we are getting a slowdown in the second half of the year.

Besides the economy turning sour, we have those that argue that deflation is just around the corner due to the macroeconomic effects such as demographics and technology. Such as notable economists Raoul Pal, Brent Johnson, and Jeff Booth. But there are also those that argue for deflation due to factors that we might consider inflationary, one of those is economist Steven Van Metre, another is Real Vision president Travis Kimmel.

Steven Van Metre has been sounding the deflation alarm for a long time. The majority view is that QE is inflationary, but Steven disagrees with this position.

Steven argues that quantitative easing is counterintuitively lowering interest rates but also tightening the financial conditions. When financial conditions tighten, the Fed is forced into easing, which causes bond prices to rally as interest rates fall. When interest rates start to fall, risk assets, such as stocks, are months away from falling alongside interest rates due to the symbiotic relationship between stock prices and interest rates.

Quantitative Easing is a reserve swap and fiscal stimulus is borrowed money, so neither is inflationary by itself. The only way either can lead to inflation is if Quantitative Easing or fiscal stimulus leads to a large amount of lending growth (QE doesn’t create money without lending). So far, banks have not shown a strong desire to lend nor have consumers or businesses show a willingness to take on more debt.

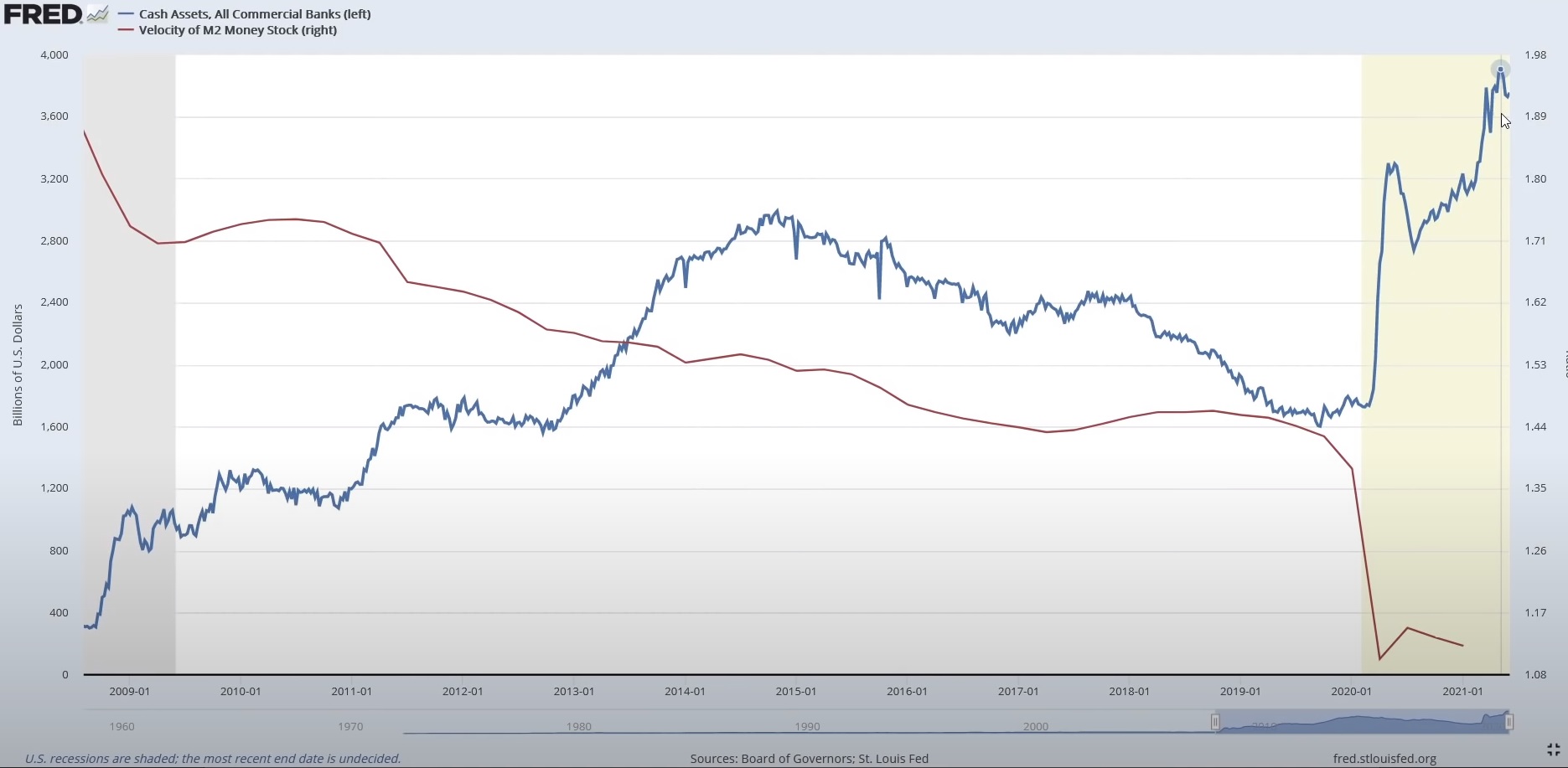

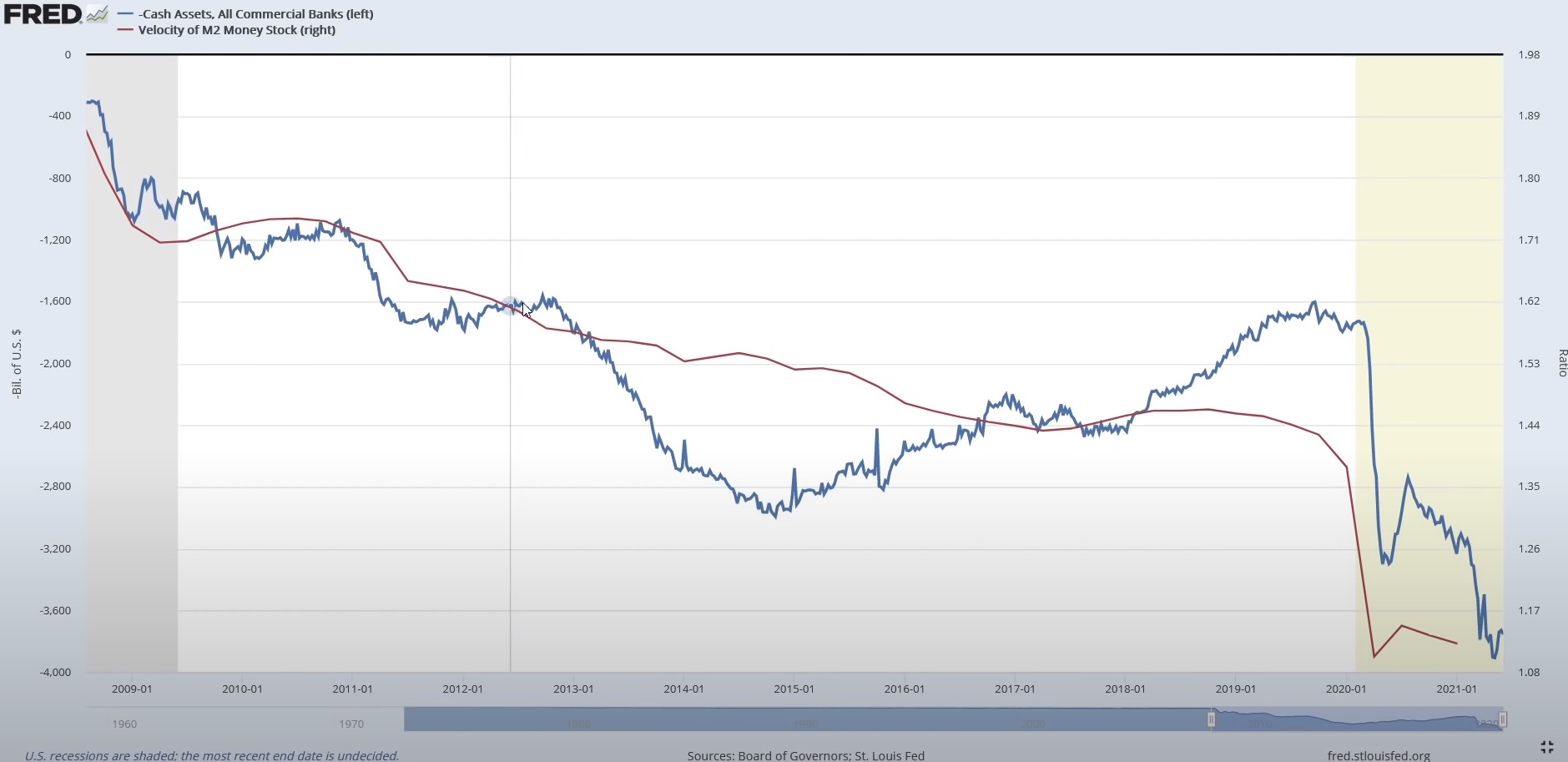

He argues that the purpose of Quantitative Easing is to strengthen the dollar by trapping dollars inside the commercial banking system which limits their movement inside the financial system. The Velocity of Money (M2) which is near its lowest point since the 1950s, is evidence of the QE-created dollar prison.

Steven believes that the FED created a liquidity trap and the problem with liquidity traps is they’re disinflationary and if they’re let run too long, they become outright deflationary. QE does reduce the velocity of dollars because the Fed has no mechanism to create or destroy money. When a reserve asset swap happens, the reserve asset created by the Fed is held at a Federal Reserve member bank and it’s accounted for on the commercial bank’s balance sheet. They got this reserve asset, but they don’t control its destiny.

When a bank creates a reserve out of a customer deposit, it chooses what it’s going to buy, and it can choose when to sell. But when that reserve is swapped for a reserve asset, the Fed is now in sole control of it. The bank cannot force the Fed to sell that reserve asset, the bank can move that reserve asset inside the commercial banking system. The FED creates what Steven calls a ‘Dollar prison’. This causes a velocity of money to get absolutely crushed and is hence an inflation killer.

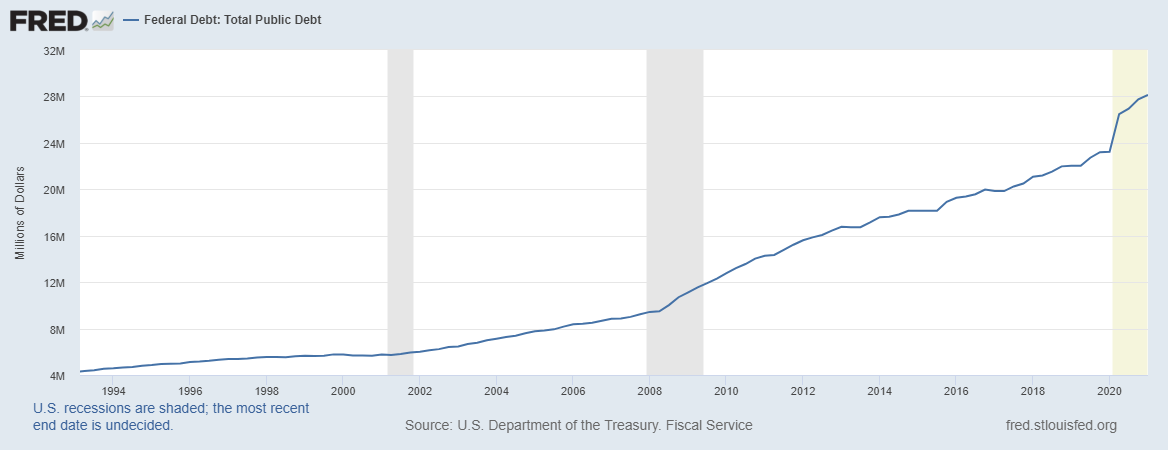

Steven argues that there are two ways out of this predicament. Either the Fed could start raising the federal funds rate and unwind their balance sheet via quantitative tightening. That would reduce the demand for money, it would drive up interest rates, and then you’d see money exiting the banking system – but higher interest rates would crash the economy burdened with massive amounts of debt. The second way out is you can get lending growth. The third way is massive amounts of fiscal stimulus, you need persistent fiscal stimulus and you need an increasing amount of fiscal stimulus – but the Federal budget is already running a big deficit and with massive federal debt and we are already seeing that in the Treasury auctions where foreign governments are not as excited about lending us money.

Since the Great Financial Crisis, when regulators were forced to consolidate the banking industry to save the financial system, four large commercial banks emerged as key to holding the financial system together. Two of those large commercial banks, Bank of America and JPMorgan Chase, are drowning in cash from repeated government stimulus programs.

It seems rather impossible there could be another financial crisis since the banks are not only flooded with deposits, but the Fed has forced the banks to create trillions of dollars of excess reserves through its Quantitative Easing program.

The commercial banking system is so overwhelmed with cash that the large commercial banks engage in zero-percent interest overnight loans with the Federal Reserve, referred to as Overnight Reverse Repurchase Agreements, where the Fed is loaning hundreds of billions of Treasury securities for cash in hopes to alleviate the pressure from all this cash on a nightly basis.

The Fed’s asset purchases have already created so much liquidity, causing bank reserves to more than double in a year to $3.8 trillion, that liquidity is now going haywire, and the Fed is feverishly engaged trying to control it by selling Treasury securities and for cash via overnight reverse repos, thus draining liquidity from the market.

Hence, the financial system is facing the exact opposite problem it faced leading into the Great Financial Crisis when a global dollar shortage manifested itself in the banking system which exploded when variable-rate mortgage loans reset higher after the Fed engaged in a prolonged period of tightening financial conditions by raising the Federal Funds Rate.

Each night, commercial banks in the U.S. are borrowing over four hundred billion of Treasury securities from the Fed since they have too much money on deposit and a lack of pristine collateral to back it with. Most of the government stimulus is being deposited at Bank of America and JPMorgan Chase.

Steven van Metre argues that there could be another financial crisis because most of the money is trapped between two banks, that those who are short dollars may be unable to access them as government stimulus and assistance expires. And that another global dollar shortage from the Fed’s last tightening cycle and a deflationary event might just seem plausible.

Cash has been trash for years but soon it may be the only haven for investors sated beyond reasonable expectations of perpetually low yields and supportive bond kings and queens.

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55124/79bc18fa-f616-4951-856f-cc724ad5d497-560x416.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55099/2638a982-b4de-4913-8a1c-1479df352bf3-560x416.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55136/b1b0b614-5b72-486c-901d-ff244549d67a-350x260.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55124/79bc18fa-f616-4951-856f-cc724ad5d497-350x260.webp)

![OpenAI. (2025). ChatGPT [Large language model]. https://chatgpt.com](https://www.illustratedcuriosity.com/files/media/55099/2638a982-b4de-4913-8a1c-1479df352bf3-350x260.webp)